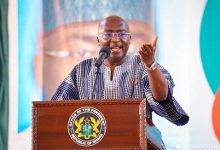

Ghana has made “significant progress” in debt-restructuring negotiations and the latest snag that sent its eurobonds tumbling on Monday will be ironed out in further talks with bondholders, Finance Minister, Mohammed Amin Adam said.

Negotiations that started mid-March resulted in an interim deal last week, with international investors holding about 40 per cent of Ghana’s $13 billion of defaulted Eurobonds, the Finance Ministry said in its X Handle.

Still, Adam conceded in an interview that agreement breaches the International Monetary Fund’s (IMF) debt sustainability parameters “slightly.”

“This is not a failure but an ongoing process to arrive at an agreement consistent with debt thresholds” under the IMF’s debt sustainability analysis, or DSA,” Adam said.

The government will “regroup with our bondholders to continue to tweak the terms until we have final terms that work for all parties,” he added.

Ghana’s eurobonds plunged by the most since December 2022, with notes due in June 2035, falling as much as 3 cents to 47.55 cents on the dollar before paring the decline.

The IMF said in a statement that the “working scenario” presented by the government of Ghana “is not in line with programme parameters.”

“The IMF will continue to support the ongoing restructuring negotiations between the authorities and their external commercial creditors with the view to reach an agreement that is consistent with program parameters,” the lender said.

The latest development brought more clarity on the broad outline of the eurobond restructuring, though the terms of an agreement would have to be “fine-tuned” to meet the IMF thresholds, said Samir Gadio, Head of Africa strategy at Standard Chartered Plc. Bond prices are now not far from recovery levels implied by the restructuring proposal, he said.

International bondholders had agreed to a 33 per cent effective nominal haircut, according to one of two options provided for the restructuring.

To meet its IMF target, the $77 billion economy needs to reduce debt to 55 per cent of gross domestic product by 2028, compared with a burden of 109 per cent that was projected for the year before Ghana began restructuring.

The current bondholder agreement would leave debt slightly above that target.

Ghana’s economy fared better than the IMF expected, expanding 2.9 per cent in 2023 compared to an initial IMF target of 1.5 per cent. That means a revised DSA would accommodate the agreement with bondholders, Adam said.

Ghana began working to revamp its debt a little over a year ago as part of a deal with the International Monetary Fund, reaching an agreement in principle with bilateral creditors in January to rework $5.4 billion of obligations under the Group of 20 Common Framework for Debt Treatment. That agreement set the tone for the restructuring of eurobond debt with assistance from Kerim Karakaya.

BY TIMES REPORTER