The Anum Rural Bank PLC posted profit before tax of GH¢ 3.98 million in 2023 representing an increase of 58.4 per cent when compared to the 2022 profit of GH¢2.51 million.

The total operating income for the period under review was GH¢20.15 million as against GH¢15 million earned in 2022, showing a growth of 34.14 per cent.

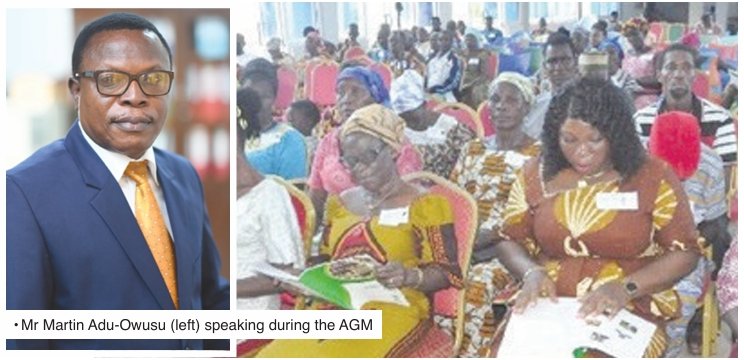

The chairman of the Board of Directors, Martin Adu-Owusu, who announced this on Saturday said the interest income in 2023 was GH¢ 18 million, representing a 34.85 increase of the GH¢ 13.3 million earned in 2022.

He was delivering his address at the 41st Annual General Meeting (AGM) of Shareholders of the bank, at Anum in the Asuogyaman District of the Eastern Region.

He said the feat was achieved despite increase in fuel prices and high utility tariffs, 25 per cent corporate tax and five per cent growth and sustainability levy that made the year a difficult one for most businesses.

However, Mr Adu-Owusu said the bank could not declare dividend due to the ongoing Atimpoku building project and opening of a new agency at Dodowa which were all capital intensive.

“Fellow shareholders, due to (these projects) the Bank of Ghana has declined the payment of dividend for the year under review to enable the bank to complete these projects without difficulty.

“It is our hope that the bank will continue to excel in the ensuing year where the project will also be completed to enable us to pay dividend for year 2024,” he said.

Mr Adu-Owusu said the total assets of the bank as of December 2023 stood at GH¢82.98 million as against GH¢69.95million, indicating a rise of 18.63 per cent.

He said the total shareholders’ funds also appreciated from GH¢8. 51million in 2022 to GH¢12.90 million in 2023, representing a year-on-year growth of 51.51per cent.

“Following the bank’s adequate liquidity during the year under review, short term investment increased by 23.27 per cent from GH¢24,257, 844 in 2022 to GH¢29, 902, 844 in 2023,” he added.

Mr Adu-Owusu said the total assets of the bank, and shareholders’ funds also recorded significant increases in the year under review, likewise loans and advances, stated capital, and capital adequacy.

He said the bank’s total deposit rose from GH¢55, 400, 917 in 2022 to GH¢61,624, 039 in 2023, a growth of 11.2 per cent.

On community engagement, Mr Adu-Owusu said the Anum Rural Bank continued to enhance the living standards and sustainable development projects with scholarships, charity and donations as part of its corporate social responsibility.

“In all, GH¢70, 418 was spent on those areas to support community development and better the lives of the people,” he added.

The Deputy Managing Director of ARB Apex Bank, Curtis W. Brantuo, commended the board and management of the Anum Rural Bank for its success story, which he said, reflected effective strategic decision-making and operational efficiency.

“It is crucial for the bank to continue this positive trajectory by identifying new growth opportunities and managing risks effectively,” he said.

BY TIMES REPORTER