The management of Groupe Nduom has petitioned John Mahama, the flagbearer of the National Democratic Congress (NDC), to restore GN Bank’s licence if he wins the December 7 elections.

GN Bank’s licence was revoked by the Bank of Ghana in August 2019.

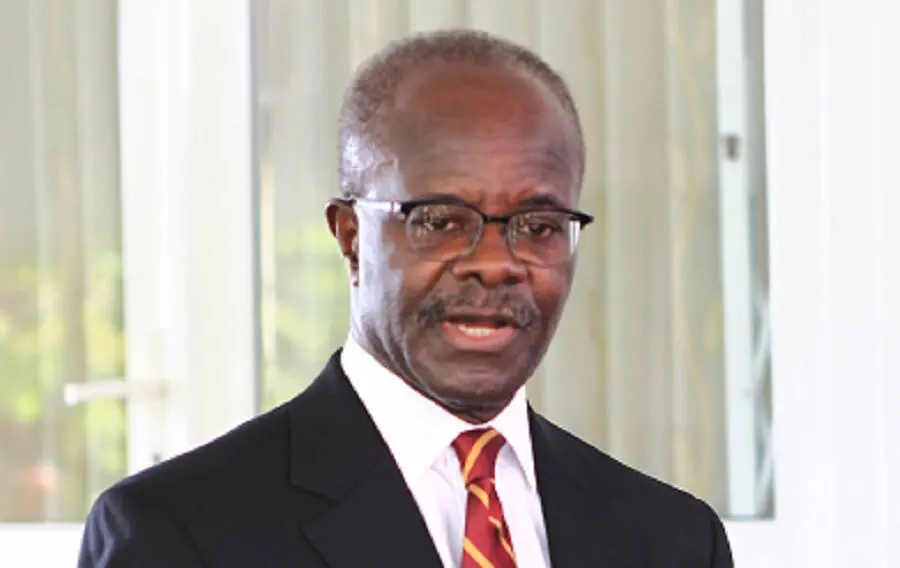

During a meeting with the former president in Accra on Friday, Dr Papa Kwesi Nduom, the Global President of Groupe Nduom, expressed concern over the deteriorating state of the bank’s 300 centres across the country.

Dr Nduom said that the collapse of the bank has led to significant job losses, causing severe hardships for the families of former employees.

He then pleaded with Mr Mahama to prioritise the reinstatement of GN Bank if he is elected in the upcoming elections, aiming to restore jobs and alleviate the suffering of those affected.

“We believe that if this administration doesn’t give us our license before they leave, and start paying the money before they leave, we believe that the next one will understand the situation and give the license back.”

“So we are continuing with the hope and preparing and working our plans with the hope that, at some point, we will get the licence back and we’ll bring the jobs back. Because it is the jobs that we are also looking for.”

Mr Mahama criticised the New Patriotic Party (NPP) government for its decision to revoke the licenses of several indigenous financial institutions as part of the 2019 banking sector clean-up, calling it a hasty action.

He revealed that his administration planned to initiate an independent review of the entire banking sector clean-up process.

“I do think that government was hasty in what it did. If you look at the criteria that was used, I mean, it didn’t fit. It was not a one-size-fits-all. I mean, it was just like different rules for different folks and so, yes, as you said, a lot of these banks had also financed government suppliers and contractors, and the government owed them and they owed the banks.”

The former President said, “But, how would they recover that money if you don’t pay the contractors to pay them? And so I do think that it was hasty, and it’s affected indigenous capital in the financial and banking sector. And we have pledged that we would work to restore, you know, the capital of indigenous businesses in the financial sector—joyonline