The Bank of Ghana (BoG) has launched the Ghana Gold Coin (GGC) as part of measures to mop up excess liquidity in the banking sector in order to enhance the stability of the Cedi.

The product under the BoG domestic gold purchase programme, is also to deepen the country’s financial market and provide more investment options for the citizens.

It is also meant to offer Ghanaians alternative form of investment from dollars and bonds to promote the stability of the Cedi.

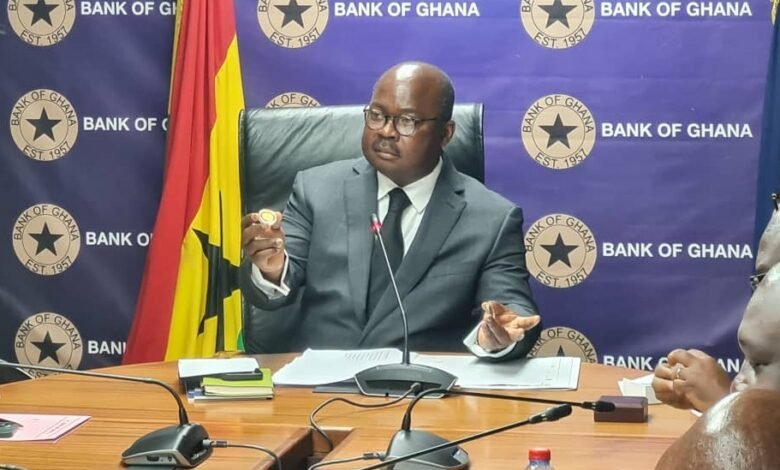

Speaking at the launch of the GGC in Accra on Friday after the 120th regular meeting of the MPC to review developments in the economy, the Governor of the BoG, Dr Ernest Addison, said the GGC would be available on the market in the next two weeks.

The MPC cut its monetary policy rate by 200 basis points to 27 from 29 per cent on the back of strong growth and declining inflation, the first time since January when the central bank cut its lending rate, after it slashed its lending rate by 100 basis points to 29 per cent from 30 per cent in November 2023.

Dr Addison stated that the GGC, issued and guaranteed by the BoG could be purchased in Ghana through commercial banks across the country, and was available in three different sizes namely, one ounce, one-and-a-half and one-and-a-quarter to suit different investment needs.

He noted that the GGC was to give Ghanaians an additional avenue to invest and reap the benefits from the BoG’s domestic gold purchase programme.

“Now, if you don’t buy dollars, you will buy treasury bills or bonds. We are giving you an opportunity from the domestic gold purchasing programme to also buy gold. This is what we are trying to launch now and we call it Ghana Gold Coin,” Dr Addison stated.

Gold, he said, had shown remarkable resilience as a financial asset and could serve as a natural hedge during periods of economic turbulence.

“The issuance of the GGC democratises access to this enduring financial asset, enabling residents to diversify their financial portfolios,” Dr Addison said.

He explained that the GGC manufactured from dore gold had been refined to 99.99 purity, which gave the coin the original gold colour.

“The holder of a GGC can sell the coin to a commercial bank, and the BoG stands ready to buy and resell in situations where a commercial bank is not able to purchase a coin,” Dr Addison explained.

“Gold used for the manufacture of the GGC are from traceable, responsibly mined sources in Ghana in line with the BoG’s Responsible Gold Sourcing Framework,” Dr Addison stated.

On the cut on the monetary policy rate, Dr Addison said the committee decided to cut its lending rate on the back of robust growth, declining inflation and positive external position.

He noted that the domestic economy continued to recover evidenced by the stronger than expected Gross Domestic Product (GDP) outturn for the second quarter of the year.

STORIES: KINGSLEY ASARE