Book on prudent money management launched in Accra

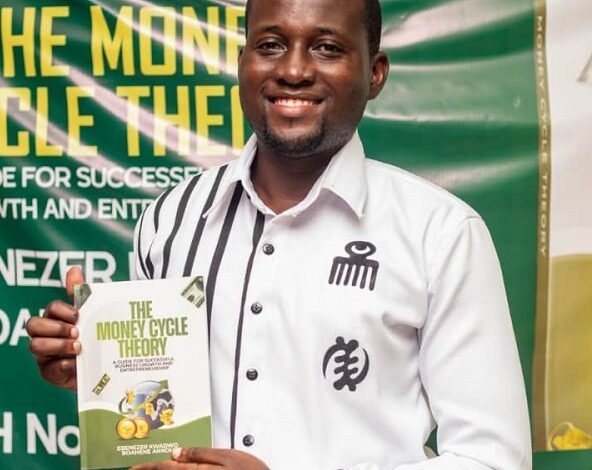

A 120-page book aimed at promoting prudent money management and sustainable business growth has been launched in Accra.

The book, “The Money Cycle Theory,” targeting individuals, entrepreneurs and businesses seek to provide a practical and culturally relevant guide on how to earn, manage and grow money effectively within the African context.

Authored by Mr Ebenezer Kwadwo Boahene Annoh, a business consultant and seasoned entrepreneur, the six-chapter book draws on the author’s personal eBook experiences and lessons learnt from financial missteps, which he said inspired him to document a framework in order to help others avoid similar challenges.

Mr Annoh explained that the book departs from the heavily theoretical approach common in many finance publications by blending practical examples, personal reflections and case studies of successful entrepreneurs.

“I wanted to bring out a guide that businesses and young entrepreneurs can look up to; something practical and something that fits into our African cultural system,” he noted.

Speaking to The Ghanaian Times on the sidelines of the highly patronised book launched, Mr Annoh outlined five key stages of money management including earning, spending, saving, investing and reinvesting, explaining that reinvestment was critical for financial growth yet, was often neglected by individuals and businesses.

He called for a shift in financial education in the country, arguing that complex economic terms often confused the public and discouraged prudent financial management and sustainability.

In this regard, he recommended a simplified framework, the “SIDE model,” which focuses on savings, investment, debt and expenditure as key pillars for sound financial management at both individual and national levels.

Rev. Isaac Yaw Omane, Resident Minister of the Prince of Peace Congregation of the Presbyterian Church of Ghana (PCG), Haatso District, stressed that the major financial challenge facing many people, particularly the youth, was not earning money but sustaining and multiplying it.

He said the inability to preserve income and grow savings had left many young people financially vulnerable later in life, noting that “The Money Cycle Theory” was timely in encouraging small, consistent savings that could translate into significant investments.

“When growing old you need money, especially for medication. If you don’t have any investment that you get money from, then you cannot take care of yourself when you are old that is why I recommend this book for each and everybody particularly the youth,” he explained. As part of the launch, the author announced that GH¢10 from every copy sold would support a digital library project and a youth entrepreneurship fund to be rolled

BY ABIGAIL ANNOH

Follow Ghanaian Times WhatsApp Channel today. https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q

🌍 Trusted News. Real Stories. Anytime, Anywhere.

✅ Join our WhatsApp Channel now! https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q