A stakeholder sensitisation forum aimed at creating nationwide awareness of the enhanced legal framework for the Corporate Insolvency and Restructuring Act, 2020 (Act 1015) (CIRA), and its accompanying Legislative Instrument, L.I. 2502, has been held in Accra.

Organised by the Office of the Registrar of Companies (ORC) in collaboration with the International Finance Corporation (IFC), the forum was on the theme: “Strengthening Business Recovery and Creditor Confidence through Ghana’s Corporate Insolvency Regime.”

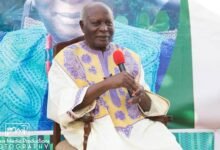

Speaking at the forum, the Deputy Attorney General and Minister of Justice, Dr Justice Srem-Sai, said the Corporate Insolvency and Restructuring Act, 2020 (Act 1015) (CIRA), stood as a landmark in the country’s legal and economic reform agenda, reflecting its determination to build a fair, predictable, and growth-oriented business environment capable of preserving jobs and protecting investments.

According to him, CIRA is a key pillar in safeguarding financial stability and promoting business recovery in the country. He said the Act, together with the recently passed Corporate Insolvency and Restructuring Regulations (L.I. 2502), represented a fundamental shift from a liquidation-oriented approach to one that prioritises business rescue, creditor confidence, and economic continuity.

Dr Srem-Sai highlighted that the Act marked a decisive shift from the old liquidation-based system to a modern, recovery-focused framework that supports business continuity, safeguards creditor interests, and enhances financial sector stability.

Speaking on the theme, “The role of the Corporate Insolvency and Restructuring Act, 2020 (Act 1015) in contributing to financial sector stability in Ghana,” the Deputy AG said that prior to the passage of the Act, the country’s insolvency framework was outdated and fragmented, offering little opportunity for distressed but viable companies to recover.

“Insolvency was often viewed as a terminal event resulting in liquidation, job losses, and diminished value for creditors and shareholders alike,” he noted, adding that the outdated framework contributed to the financial sector’s instability by increasing the burden of non-performing loans.

According to him, the new Act provides a modern and coherent system that aligns with international best practices, especially the United Nations Commission on International Trade Law (UNCITRAL) Legislative Guide on Insolvency Law.

The key features of the Act, Dr Srem-Sai said, include corporate restructuring and administration mechanisms, professional licensing for insolvency practitioners, stronger creditor protections, and the introduction of cross-border insolvency provisions.

He explained that the reforms would strengthen the country’s financial system by improving loan recovery rates, boosting investor confidence, and ensuring a transparent process for addressing corporate distress.

The Acting Registrar of Companies, Mrs Maame Samma Peprah, said the forum aimed to create nationwide awareness of the Act and its accompanying Legislative Instrument, L.I. 2502, which came into force in July this year.

She said the ORC was focusing on sensitisation, particularly among Small and Medium-Size Enterprises (SMEs), which often lacked knowledge of business rescue procedures.

Mrs Peprah said the law clearly defined the roles of administrators, liquidators, directors, and creditors, while ensuring high standards for insolvency practitioners, including their appointment, remuneration, and accountability.

The Senior Country Manager of IFC for Ghana and Liberia, Mr Kyle Kelhofer, commended Ghana for enacting the Act and its regulations, saying it demonstrated strong commitment to creating an enabling business environment.

BY CECILIA YADA LAGBA AND BLESSING ATALATA MOSES

🔗 Follow Ghanaian Times WhatsApp Channel today. https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q

🌍 Trusted News. Real Stories. Anytime, Anywhere.

✅ Join our WhatsApp Channel now! https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q