The Ghana cedi is expected to recoup some losses against the dollar in the coming months, Fitch Solutions has revealed.

According to the London-based firm, this is due to improved investor sentiment, higher dollar inflows, and easing external conditions,

In an article dubbed “Sub-Saharan Africa currency round-up: greater stability ahead in second half of 2024”, it said external conditions would offer more support to Sub-Saharan African currencies in the coming quarters.

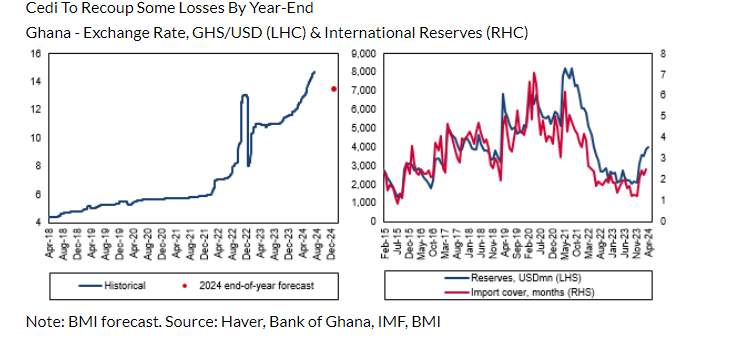

“We expect the Ghanaian cedi to fare better in the second-half of 2024. In the year to date, the cedi has lost 19.2 per cent of its value against the US dollar, positioning it among the worst performing currencies globally,” it said.

It said subdued market sentiment amid debt restructuring negotiations has kept capital inflows weak, while the start of an economic recovery – real Gross Domestic Product growth accelerated from 3.8 per cent in the fourth quarter of 2023 to 4.7 per cent year-on-year in the first quarter of 2024 had increased demand for foreign exchange.

“Furthermore, Ghana’s international reserves have remained low, covering just 2.5 months of imports in March. Combined with International Monetary Fund agreements to allow the exchange rate to adjust to market conditions, this has led to limited foreign exchange intervention by the Bank of Ghana in the year-to-date,” it added.

Fitch Solutions projects that the cedi will regain value by 9.0 per cent by year-end, from the July 9, 2024 spot.

On July 8, Ghana reached an agreement with international bondholders to restructure US$13 billion worth of external debt, a process that should be concluded by the end of September 2024.

Fitch Solutions said it believed that this would improve investor sentiment towards Ghana, improve capital inflows and provide appreciatory pressure to the unit.

“Moreover, the start of a monetary easing cycle in the US in September will likely put some pressure on the dollar and improve investor appetite for higher-yielding emerging market assets, providing tailwinds to the cedi,” it said.

The cedi is presently going for GH¢15.75 at the forex bureau. It has depreciated by about 20 per cent against the American greenback.

BY TIMES REPORTER