All eligible taxpayers, including members of Ghana Revenue Authority (GRA) Ghana Union of Traders (GUTA), are expected to charge and account for VAT at the applicable effective rate of 20 per cent.

This would comprise VAT, the National Health Insurance Levy (NHIL), and the Ghana Education Trust Fund (GETFund) Levy, which would continue until the end of the first quarter of implementation, in accordance with the law.

The two entities, in a joint statement copied to The Ghanaian Times yesterday, said the agreement was reached after a consultation meeting to deliberate on the implementation of the Value Added Tax Act 2025 (Act 1151) with particular focus on its implications for traders who previously operated under the VAT Flat Rate Scheme.

The approach, according to the joint statement, aims to facilitate the rollout of the new system while enabling GUTA to provide feedback to GRA regarding the concerns raised during the meeting.

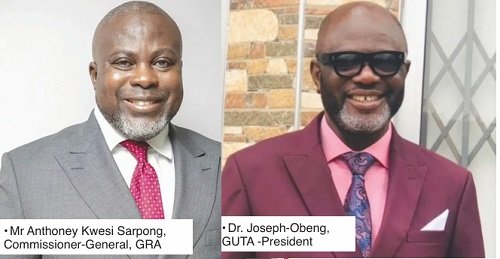

The meeting, attended by the Commissioner-General and Management of the GRA as well as the President and Executives of GUTA, formed part of efforts to ensure a smooth transition to the new VAT regime and to address concerns raised by traders following the passage of the legislation.

The statement noted that discussions centred on the impact of the VAT reforms on GUTA members, the majority of whom were accustomed to the flat rate system, and the transitional challenges associated with the shift to a standard VAT accounting framework.

It said the meeting ended with both parties agreeing that all eligible taxpayers would be required to charge and account for VAT at an effective rate of 20 per cent, in accordance with the law.

To further address sector-specific concerns, it added that a joint technical team comprising representatives from both GRA and GUTA would be established.

The team would focus on issues such as VAT record keeping, input VAT claims, VAT computation, and compliance requirements, and would make recommendations for possible reviews where necessary.

Also, the statement said the two institutions agreed to intensify education and sensitisation programmes nationwide to guide traders through the transitional arrangements and enhance understanding of their obligations under the new VAT regime.

This, GRA reassured traders, particularly those migrating from the VAT Flat Rate Scheme, of its commitment to a collaborative and supportive approach aimed at ensuring a seamless transition and sustained compliance.

GUTA, on its part, urged its members to adhere to the provisions of the new VAT law and to engage constructively with tax authorities to resolve operational challenges.

The organisations reaffirmed their commitment to continuous dialogue and cooperation, stressing that the reforms were being implemented in the broader interest of traders, consumers, and national development.

BY CECILIA YADA LAGBA

🔗 Follow Ghanaian Times WhatsApp Channel today. https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q

🌍 Trusted News. Real Stories. Anytime, Anywhere.

✅ Join our WhatsApp Channel now! https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q