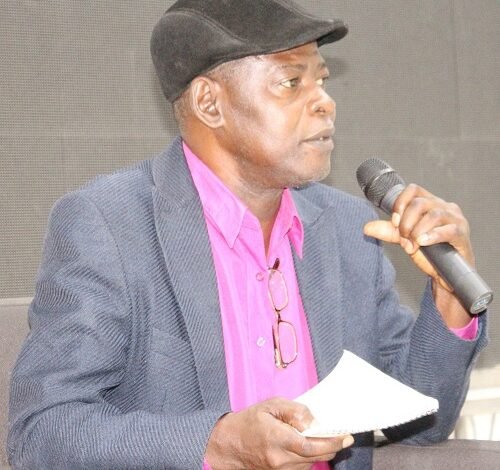

A former Chairman of the Public Interest and Accountability Committee (PIAC), Dr Steve Manteaw, says part of the country’s oil money should be invested and its dividend used to fund the Free Senior High School (SHS) programme.

According to him, that would be a sustainable way to fund the programme instead of the current arrangement whereby a chunk of the revenue was challenged into funding the programme.

Contributing to a panel discussion at a public lecture on the use of the country’s oil money in Accra yesterday, he saidhe was not against the programme but “Using oil revenue to finance free SHS hasn’t been a prudent decision. My overriding consideration is the sustainable finance of the programme.”

The lecture, organised by PIAC on “10 years of the management and use of petroleum revenues in Ghana: The way forward,” was created as a platform for a discussion on PIAC’s 10 years (2011-2020) assessment of the management and use of the country’s petroleum revenues released earlier this month.

According to Dr Manteaw, the Petroleum Revenue Management Act 815 (2011) as amended by Act 893 (2015) requires that the country invests 70 per cent of oil revenue into capital investment, but since 2017, it has been impossible to keep faith with this provision in the law largely on account of free SHS.

Two economists -Dr TheophilusAcheampong, who addressed the lecture and Dr Kwame Baah-Nuakoh – expressed divergent views on the management of the Ghana Heritage Fund (GHF).

The former said the country should look for a quality investment strategy that would fetch better returns while the latter opined that the country could borrow from it instead of borrowing from global markets at higher rates.

The Petroleum Revenue Management Act 815 (2011) as amended by Act 893 (2015) set up the GHF to save oil revenues for future generations when the petroleum reserves would have depleted.

It receives nine per cent of the country’s share of oil revenue and had $586 million of the $6.55 billion which Ghana earned from the $31.22 billion generated from Ghana’s three producing fields during that period.

Dr Acheampong, also a political risk analyst, who delivered the lecture said in 10 years the returns from the investment of the fund was about one per cent whereas returns from the stock market and other investment avenues were within 15 to 20 per cent.

He said the country could invest the fund locally and earn more, and in addition, put legal measures in place to prevent politicians from accessing the investment.

“The fund should stay but we must find a better investment instrument,” he said.

Touching on Ghana National Petroleum Corporation (GNPC), Dr Acheampong said there was the need to protect the Corporation from political interference so it could focus on its core mandate.

Sharing his personal opinion on the GHF, Dr Baah-Nuakoh, who is the General Manager of Sustainability and Stakeholder Relations of the GNPC, said borrowing from the fund would save the country from borrowing more from the international market.

“We are saving for the future generation and borrowing for the same future generation so if we are borrowing at a higher rate than we are saving, we are actually leaving them debts,” he said.

On GNPC expenditure, he said, it was approved by parliament so the corporation could not be said to be spending on the government’s agenda instead of its core mandate.

BY JONATHAN DONKOR AND ANITA ANKRAH