NSA adopts GHANA.GOV platform for payments, revenue collection

The National Service Authority (NSA) has digitised its payment system, transitioning to a cashless system. Cash payments are no longer allowed at the authority, officials have said.

The NSA’s latest decision aligns with the government’s drive to modernise revenue collection.

The GHANA.GOV web portal used by the government for revenue mobilisation is the platform the NSA is leveraging its digital payment transition.

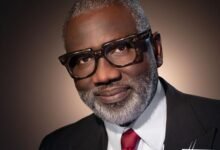

According to the Director-General of NSA, Mr Felix Gyamfi, the NSA’s clients including agencies and stakeholders are now required to make all payments to the authority through the GHANA.GOV platform.

This digital payment system, he said, offers unparalleled transparency, convenience, and accessibility, enabling users to make payments any day and time from anywhere in the country.

“The (link unavailable) platform provides a unified digital avenue for accessing government services, offering a range of seamless payment options, which includes bank cards, mobile money, online banking, QR Code, account-to-account transfer, SWIFT Transfer, and ACH Transfer,” he stated.

Mr Felix Gyamfi said in a statement that users would be able to make payments 24 hours a day, seven days a week, from anywhere across the country.

This flexibility eliminates the need to physically visit a payment centre or wait in a queue to pay at the authority, saving users time and effort.

Furthermore, the digital payment system which is a Digital Public Infrastructure (DPI) is so accessible that one can make payments anywhere at any given time by using various devices and platforms, including mobile phones, tablets, laptops, and desktop computers.

The system’s accessibility is also enhanced by its user-friendly interface, the platform is designed to be intuitive and easy to navigate, making it simple for users to find the information they need and complete transactions quickly and efficiently.

To make it inclusive for all, he said the Ghana.gov platform has several payment options, so clients who were not conversant with technology and digital systems could use the money phone option by dialling *222* and follow the prompt to make payments.

About GHANA.GOV

platform

The GHANA.Gov platform became operational in July 2021 to facilitate access and payments for government services and promote transparency and visibility of internally generated funds.

State agencies like the Passport Office, the Ghana Revenue Authority (GRA), the Lands Commission, the Food and Drugs Authority (FDA), the National Information Technology Authority, the Registrar General’s Department, and the National Schools Inspectorate Authority have already adopted the platform for their payments and revenue collection.

As at February 2024, 1507 agencies had operationalised the platform.

Over GH¢210 billion worth of transactions had taken place via the Ghana.gov platform as government revenue since it was introduced, underscoring the platform’s pivotal role in streamlining financial transactions, enhancing transparency, and bolstering the nation’s fiscal integrity.

Ghana makes progress

on cashless payment

A cashless payment system is a method of conducting transactions electronically, where individuals pay for goods or services without using physical cash.

Instead, they rely on digital methods such as credit cards, debit cards, mobile wallets, online banking transfers, digital wallets, or other electronic payment platforms to transfer funds directly between accounts.

The digital payment system introduced by NSA is a significant leap forward in terms of transparency, convenience, and accessibility, while empowering users to make payments at any time and from any location within the country.

Potential challenges

With this transition, Ghana takes a significant leap towards joining the ranks of countries embracing digital payments and promoting a cashless economy like the United States, United Kingdom, China, Brazil and South Korea.

The proliferation of digital payment systems relies heavily on the availability and reliability of strong and steady network connectivity.

There are many communities still without reliable network connectivity to support efficient adaptation of the NSA’s preferred digital payment system.

The NSA’s decision to go digital is a significant step towards achieving the government’s objective of establishing a cashless economy, but fixing the connectivity problem would be a boost.

As the country also continues on this path of a cashless economy, there are concerns about associated risks of fraud. NSA officials are hopeful the GHANA.GOV platform is robust to make it safer for transactions.

“And so whatever you do from your end is secure and privately, and same at our end too, and once we do any business with them on the Ghana.gov, immediately they get their alert, they get their invoices onto their secure emails which is very safe and secure,” Director of Corporate Affairs of NSA, Mr Armstrong Esaah assured.

We can assure our partners and clients that the Ghana.gov platform is very safe, very, very secure, very convenient, so we want to encourage all of them to use this payment option,” he added.

This report is produced under the DPI Africa Journalism Fellowship Programme of the Media Foundation for West Africa (MFWA) and Co-Develop

BY CECILIA YADA LAGBA