Enyan Denkyira Rural Bank posts historic profit in 2023

The Enyan Denkyira Rural Bank PLC in the Ajumako-Enyan-Essiam District of the Central Region posted a profit of GH¢1.073 billion after tax in the 2023 financial year.

The profit, the highest in the bank’s history, is 290.46 per cent increase over GH¢274, 722 million recorded in 2022.

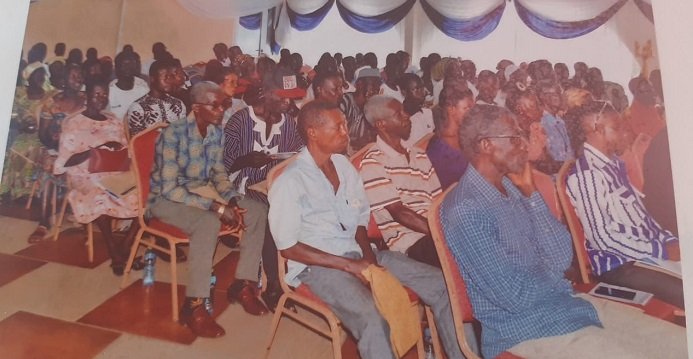

The Board Chairman of the bank, Dr John Kofi Mensah, who disclosed this at the bank’s 41st Annual General Meeting (AGM) last Saturday, said the operating income of the bank increased to GH¢11.368 billion in 2023 from GH¢7.907 billion in 2022, representing a growth of 43.76 per cent.

He said the bank recorded a significant growth in total deposits, from GH¢24.909 billion in 2022 to GH¢33.382 billion in 2023.

“The bank’s total assets of GH¢31, 903,145 in 2022 increased to GH¢41, 973,515, representing a growth of 31.56 per cent,” Dr Mensah stated.

He said the bank’s loan portfolio of GH¢16.229 billion in 2022 increased to GH¢22.215 billion in 2023, representing a growth of 36.88 per cent.

“The bank maintained the required benchmarks (even above the benchmarks) for Capital Adequacy Ratio, Primary and Secondary Reserves, throughout the 2023 accounting year,” Dr Mensah stated.

“These indicators showed how resilient the Bank is, and the good fortunes and opportunities that await us in 2024 and beyond,” Dr Mensah added.

In view of the sterling performance in 2023, the Board Chairman said the Board of Directors proposed a total dividend of GH¢203, 256.00 for the financial year 2023 to be paid to shareholders subject to approval by the Bank of Ghana (BoG).

Dr Mensah said the bank exhibited strong corporate governance in 2023 in line with the BoG standards, adding that the Board, through its subcommittees (Audit, Credit and Risk Compliance) and the various management committees, worked together to ensure sound business practices throughout the year 2023.

The Board Chairman said the bank had instituted strong measures to strengthen loan monitoring and collections.

“Credit risk management has been strengthened and we shall continue to intensify our deposit mobilisation drive as well,” he said.

He appealed to shareholders to buy more shares and invited prospective ones to join the ownership of the bank.

Dr Mensah said the bank was optimistic of achieving its planned goals in spite of the challenges to the operations of the bank.

The President of the Central Regional Chapter of the ARB Apex Bank, Kweku Kum, in remarks made on his behalf by the Vice President, Kwaku Bonsu, commended Enyan Denkyira Rural Bank for showing excellence performance in the 2023 financial year.

He said he was particularly excited about the growth in its stated capital and also appealed to shareholders to buy more shares to increase its capital.

The DCE of Ajumako-Enyan-Essiam District, Ransford Kwesi Nyarkoh, appealed to the bank to increase its investment in Corporate Social Responsibility by allocating at least two per cent of its annual profit to CSR activities.

FROM KWEKU GYASI

ESSEL, AJUMAKO OWANE