More than one billion dollars allocated to the Ghana Stabilisation fund (GSF) from 2011 to 2020 has been used for debt repayment, the Public Interest and Accountability Committee (PIAC) has revealed.

The GSF has been set up to cushion the impact on or sustain public expenditure capacity during periods of unanticipated petroleum revenue shortfalls.

But according to the PIAC, the amount used for debt repayment represents 74 per cent of the $1.39 billion allotted to the fund since crude oil production commenced in late 2010 to December 2020.

Half of the debt repayment amount went into the Sinking Fund and the 24 per cent allocated to the debt service account.

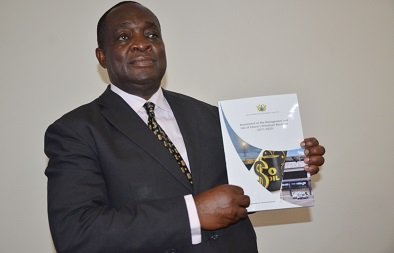

PIAC captured these in a report titled “Assessment of the management and use of Ghana’s Petroleum Revenues (2011-2020)” which examined how the country’s petroleum resource had been utilised over the ten-year-period since oil was discovered in commercial quantities.

Launched in Accra yesterday, it was compiled in line with Ghana’s Petroleum Revenue Management Act (PRMA), 2011 (Act 815, as amended by Act 893) and Petroleum Revenue Management Regulations, 2019 (L.I. 2381).

It was carried out by Stobe Law Limited, with funding from State Secretariat for Economic Affairs of Switzerland through the Governance for Inclusive Development programme of GIZ.

According to the report, 21 per cent of the GSF was allocated to the Contingency Fund to deal with national emergencies such as the COVID-19 pandemic and another four per cent to shore up Annual Budget Funding Amount (ABFA) shortfalls.

“Interestingly, only four per cent was utilised to shore up ABFA shortfalls. These debt repayments are symptomatic of developments within the Ghanaian economy over the past decade: low domestic revenue mobilisation and increased interest payments have occasioned excessive borrowing (both domestically and externally) to meet budgetary shortfalls,” it said.

On Ghana National Petroleum Corporation (GNPC), it said, of Ghana’s US$6.55 billion total oil revenue entitlements since the commencement of oil exports from 2011 to 2020, the report said GNPC had received 30 per cent ($2 billion).

The amount, it said, represented both equity financing costs and other operational expenses made by the GNPC.

It said GNPC’s total equity financing costs amounted to US$1.14 billion over the period, representing 55 per cent of the total GNPC allocations and other expenditures such as staffing and other operational costs amounted to US$921 million or 45 per cent of total allocations.

It said analysis of the data and trends over the past ten years revealed that part of GNPC’s equity had been used to meet other government priorities/needs/programmes, which were not aligned with its mandate.

“The Corporation is subject to external interference or political capture, which often compels it to undertake quasi-fiscal expenditures and advances to other parastatals,” it said.

The PIAC report said the GNPC needed the right corporate governance structure to operate commercially, thus the appointment to the GNPC Board based solely on technocratic expertise, while it needed to re-prioritise its investment portfolio.

PHOTOS BY VINCENT